Financial Fraud?

Copyright © 2010 by "Small Victories Exposed LLC" ·

All Rights reserved ·

E-Mail: webmaster@smallvictoriesexposed.com

Search Engine Submission - AddMe

NEW FINANCIAL INFORMATION LEADS TO

MORE SERIOUS QUESTIONS

Small Miracles, an entity controlled by Daniel and Angela Michael, has surfaced. This entity has substantially the same purpose* as Small Victories, and shows an additional 20 hours per week in volunteer time spent by Daniel Michael (besides the 40/week shown for him with Small Victories), raising further questions about where the money from these ministries actually goes. How can someone put in 60 hours per week in unpaid ministry work (as they claim), and then find the time to earn a living to pay for all of the expenses required for a very large family? Are they really being honest about where the money is going?

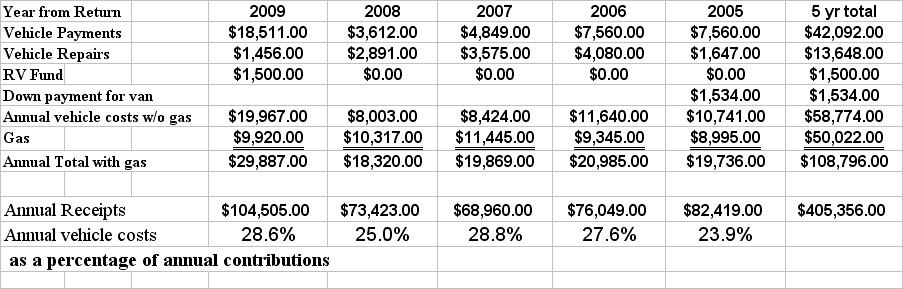

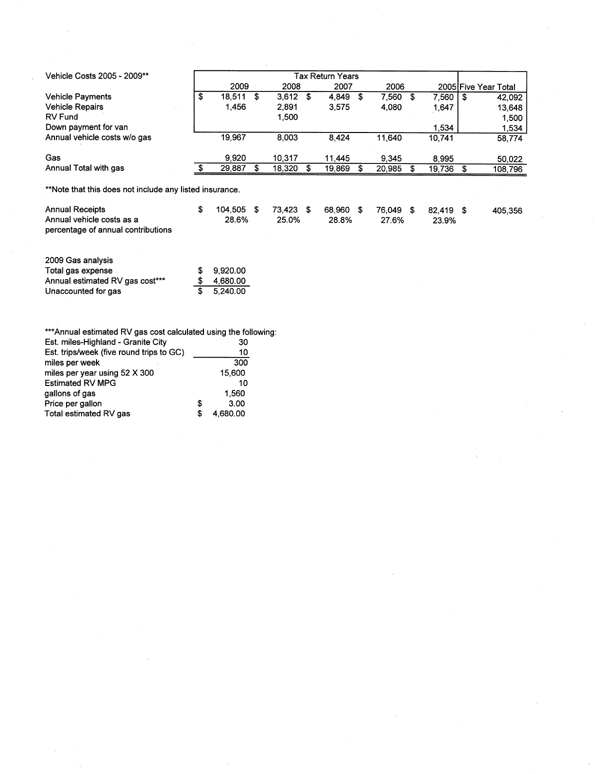

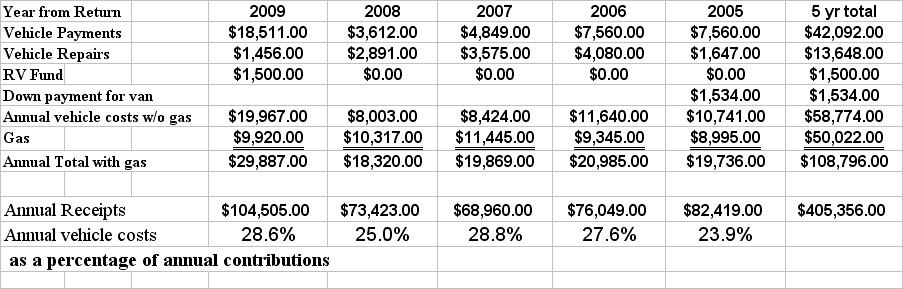

The 2009 Small Victories tax return shows almost $30,000 spent in vehicle costs during the year. Add this to the previous four years results in a five-year total of over $108,000 spent on vehicles! This includes over $50,000 in gas!! You read that right - FIFTY thousand is what they reported to the IRS. Even the Better Business Bureau has a negative report on Small Victories, documented below.

View the actual Tax returns here.

Again, these tax returns are labeled for public inspection, and can be independently verified with the IRS or through Guidestar.org.

Details for “SMALL MIRACLES”

Small Miracles is an entity that describes itself as one that is to “help moms & kids with food, housing & baby items.”* The President of Small Miracles, Daniel Michael, listed that he put in an average of TWENTY hours per week for Small Miracles. Adding this to the FORTY hours per week from Small Victories totals a stunning SIXTY HOURS PER WEEK! This raises more questions:

1)How does a man put in sixty hours per week doing volunteer work and then have time to earn a living to support a large family, including several which are college aged? When considering all of the costs needed to raise a very large family including housing, food, clothing, medical costs, college tuition, vehicles, gasoline, insurance, etc., one can easily imagine an earner needing to make at least $80,000/year for all of this. Does he actually work a paying job that can earn this much money? Or do they perhaps have another source of income that has not been made public?

2)Daniel reportedly works as a waiter to make ends meet. Can anyone explain how a waiter working in Highland can support a family AFTER giving sixty hours per week on volunteer work? If you the reader can show us the numbers to make this work, we will print them on this website. Perhaps he is just a lot smarter than the rest of us who have to work long hours just to support ourselves and our families in this economy. Make sure you factor in the costs of at least some of his children in college - after all, these can be some of the most difficult financial costs a parent can face.

Click on the images below to view Small Miracles returns as they were filed with the IRS in PDF format.

(Link opens in a new window. )

Click the images below to view the Small Victories Tax Returns from this article. (Opens in a new window)

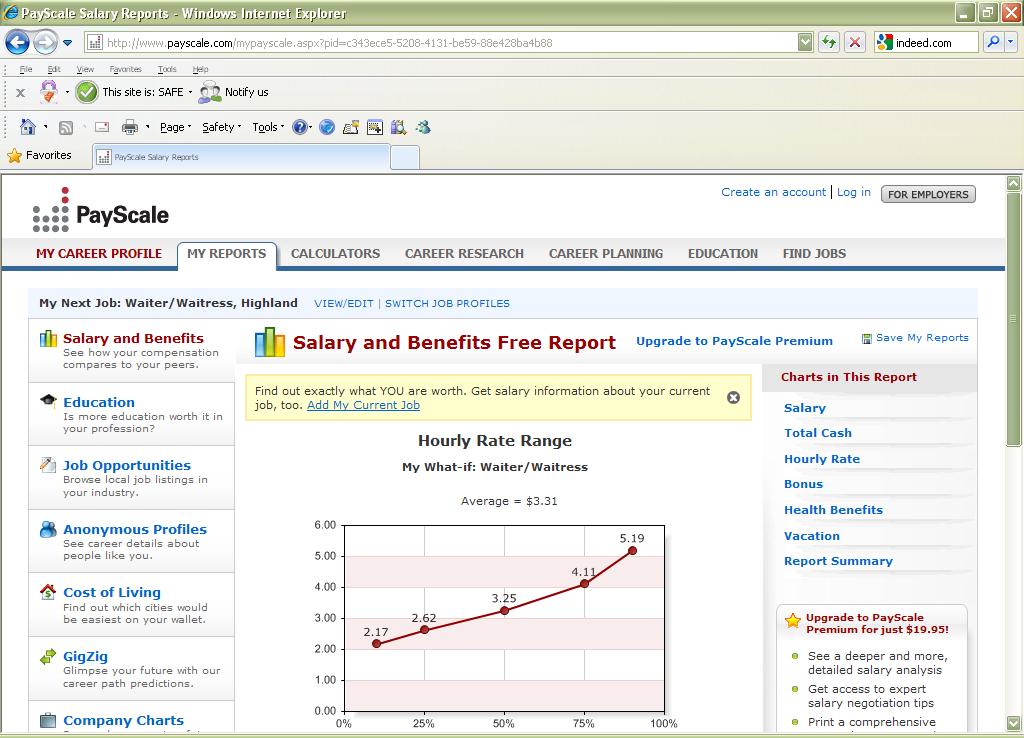

We decided to see what an average waiter makes working in Highland with twenty years of experience. The chart below contains the answers. Using the data, the highest wage listed is $5.19/hour. This does not include tips though so he would have the potential of earning a lot more than that.

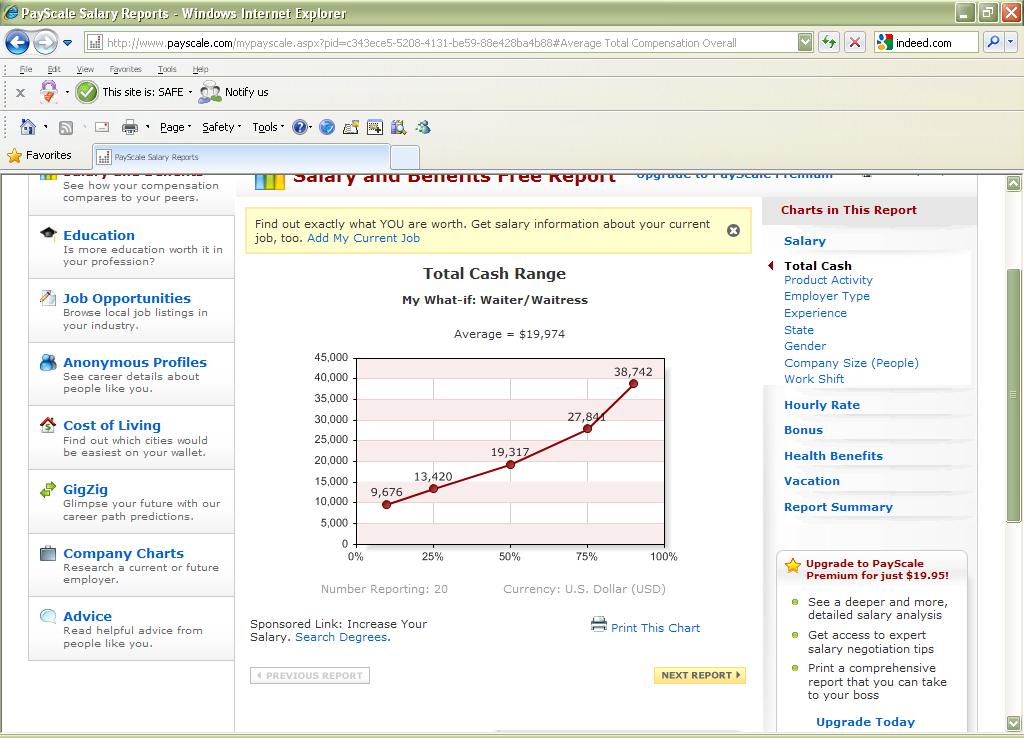

To get a better idea of what the entire pay package would be of being a waiter in Highland, the next chart shows that while the average pay is $19,317 per year, one of the higher amounts shown is $27,841 per year or about $13.39 per hour (working 40 hours per week).

Let’s assume he makes one of the higher amounts on the chart ($13.39/hour), and works at Michaels Restaurant for every hour the store is open the entire year. If you look at the hours Michaels Restaurant operates http://www.michaelsrestaurant-highland.com/ that comes out to 52 hours per week that they are open. If we assume he takes no time off to eat or for anything else, and works all 52 hours every week, getting paid $13.39/hour in tips the entire year, that comes out to about $37,500 for the year with overtime!!

3)Reality Check - can you think of anyone you know that works to support a family and then has enough time to put in just forty hours per week of volunteer work? If you can, then what would it look like if they added another twenty hours on top of that? Let’s say he works fifty hours per week as a waiter and can miraculously make ends meet that way. That would total 110 HOURS per week for all of these. That is equivalent to two and one-half full-time jobs!! Perhaps he has incredible stamina and discipline, and makes extraordinary tips on a regular basis? If anyone has actually been to Michaels Restaurant, we would like to know if you have actually seen Dan Michael working there when you visited.

Let’s assume for a moment he really does work 60 hours per week in volunteer work. Then let’s give him the benefit of the doubt that he works all 52 hours per week at Michaels. Let’s say he has to then drive 15 minutes each way to work, twice per day, six days per week. Then for good measure, we shall say he sleeps seven hours per night. Here are the weekly totals:

40 hours for Small Victories

20 hours for Small Miracles

52 hours work as a waiter

3 hours travel to and from work

49 hours sleep

164 hours total

168 hours are in one week

4 hours is the remainder. This can be used for all of the other things in his life: To take care of the family, house, cars, doctors appointments, exercise, entertainment, hobbies, etc.

Does anyone think he actually puts in that many hours of work??

According to the Small Miracles tax return, the three directors put in a total of fifty hours per week on average. The return also shows they had less than $10,000 to work with for the entire year, and we are to believe they put in 2,500 man hours in one year on this? To put this in perspective, this is more time than required for a typical full-time job for AN ENTIRE YEAR. What are they doing with all of this time? Does this sound right?

If they are not being truthful and up front with their supporters and would-be donors with what they do with the money, and are using it for personal uses, then they are acting fraudulently and illegally. They are then taking funds from generous and concerned pro-lifers who have been duped into thinking the money is going towards pro-life work when they would actually be going into the pockets of the officers of Small Victories. They would be taking us as gullible people who will give to them as long as they appear confident, claim they are doing the Lord’s work, and tell us how much they do on their own weekly street report that supposedly confirms how much God is using them, fooling laity and clergy alike.

From an accounting standpoint, there are virtually no accounting controls (safeguards) in place that an outsider can look to that tells them their money is being handled honestly (none that we are aware of). There is no accounting for the funds whatsoever to their donors. Even though this website has documented that they are not who they say they are (SEE HONESTY PAGE), (see Nursing Page)they lie about who others are (again, documented by this website (SEE BLATANT HARRASMENT PAGE, SEE K of C Conflict Page, and that when asked for proof of their outrageous claims about others, they offer none, saying that you must take their word for it. Given all of this, WHAT MAKES US THINK WE CAN JUST TAKE THEIR WORD FOR IT THAT THEY ARE HANDLING THEIR FINANCES CORRECTLY?

Using the numbers calculated above, how can he possibly make ends meet with only $37,500 per year for such a large family? Where do they get the money for all of those costs?? Some have even speculated that the money is being used for tanning salon and other cosmetic costs (note this photo dated as of the middle of winter):

Even the Better Business Bureau has contacted them for financial information and was refused:

BBB Comments

Despite written Better Business Bureau requests, this organization has not provided current information or has declined to be evaluated in relation to the BBB's charity standards. While participation in the BBB's charity review efforts is voluntary, the BBB believes that this lack of cooperation may demonstrate a lack of commitment to transparency.

You can see the link for yourself here:

http://www.bbb.org/stlouis/business-reviews/charity-soliciting-locally/small-victories-in-highland-il-310049630

With no transparency to their donors (besides tax returns required by law), major questions remain unanswered. Where is there money going? Why don’t they show this information to anyone? Why do they spend such an enormous amount of money on vehicles costs? Who pays for all of their children? Why do they get so angry when people question their finances?

Could the following statement from Small Victories website be applied to themselves on a smaller scale with what they REALLY do with the finances and how they treat so many other pro-life groups:

“In order to keep large pro-life groups going, it takes lots of money. Millions of dollars are given to pro-life groups in America ; most of the money goes to salaries, offices, fund-raising groups, etc. Very little trickles down to actual pro-life work. In order to keep the money flowing, the fund-raisers must convince those on the mailing lists that their organization is the most fruitful in stopping abortion….Besides these who desire fortune, the pro-life movement is wrought with fame seekers, who will step on other groups’ backs, just to get their name in print or their face on TV. Over the years, I have witnessed shameful acts on the part of pro-life leaders to promote themselves and their own agenda….

~Pastor Ed Martin

Be encouraged~ Angela” (From November 13-18, 2006 street report).

*Based on the descriptions listed on the 2009 Small Victories and 2009 Small Miracles returns.

^If anyone has ever seen documentation of Small Victories/Small Miracles books directly from their directors, please notify us with details and we will modify this section.

Small Victories 2009 Tax Return

The main issue we are focusing on for this year is the money spent on vehicle costs. Please note that all of this is documented by the tax returns signed by Daniel Michael, Secretary/Treasurer of Small Victories.

They spent almost $30,000 for vehicle costs in 2009 alone, with $18,000 of that reported for just vehicle payments. Adding the 2009 numbers to the previous four years, they spent over $45,000 in vehicle payments, not including repairs or gasoline. Where did this money go? If they are using multiple vehicles, and the ministry is paying for all of the expenses, then WHY? Would this make a difference to their donors if they understood that Small Victories was paying all of the costs of two or three vehicles BEFORE using the money directly for the women and babies?

And speaking of gasoline, they recorded over $9,000 in gas payments during the year (over $50,000 over the last five years)!! If the ministry uses only the RV, then over $5,000 in gas is unaccounted for in 2009 alone. This is based on the Gas Calculation Assumptions and separate calculations below.

Gas Calculation Assumptions

It is approximately a 30-mile drive each way from Highland , IL to Granite City , IL.

Let’s say they drive round-trip five days per week. That’s 30 X 2 X 5 = 300 miles per week. Take that times 52 gives you 15,600 miles per year. Let’s say the vehicle gets 10 MPG^. That’s 1,560 gallons. At $3.00/gallon that’s $4,680. That leaves over $5,000 in unaccounted for gas. Doing the math on the additional gas cost, that comes out to over 17,000 RV miles of gas that seems to be unaccounted for, or 34,000 - 40,000 miles of unaccounted for gas on vehicles with better MPG.

If they can prove their gas charges are all legitimate, and were just for the ultrasound van, then we will promptly remove this portion of the site, and issue a public apology.

(^We contacted an owner of a similar, if not identical model used primarily by Small Victories in 2009, and they estimated their vehicle gets 19 MPG for highway. However, since the one for Small Victories used additional gas for ultrasound purposes, and mileage estimates vary, we just used 10MPG.)

If you like hard numbers and analysis, then get ready to dig in:

2009 Gas analysis

Total gas expense $ 9,920.00

Annual estimated RV gas cost*** $ 4,680.00

Unaccounted for gas $ 5,240.00

***Annual estimated RV gas cost calculated using the following:

Est. miles-Highland - Granite City30

Est. trips/week (five round trips to GC)10 miles per week 300

miles per year using 52 X 300 15,600

Estimated RV MPG10

gallons of gas 1,560

Price per gallon $ 3.00

Total estimated RV gas $ 4,680.00

Search Engine Submission - AddMe